Berkshire Hathaway has all the time been publicly traded even pre-Buffet days, however it surely was in 1996 that Class B shares have been launched because the market cost of Class A shares have been spherical $30,000, making them prohibitive to nearly all of retail investors. The Class B shares have been launched at a gorgeous cost of $1,000, which allowed buyers to get a slice of Berkshire Hathaway with no having to go to unit trusts or mutual funds that have been designed to trace the efficiency of the company. As of September 2020, it stays the most important monetary providers supplier on the planet by sales and its shares have already recorded essential milestones.

In fact, its Class A shares maintain the report of the very best ever historic inventory worth at over $339,000; whilst its class B shares have been a mainstay major 10 element of the S&P 500 for a lot of years. The inventory is listed on the NYSE, the place it trades beneath the ticker image BRK-B. It is included within the Financial Services sector, beneath the Insurance-Diversified industry. Headquartered in Omaha, Nebraska, Berkshire Hathaway is a multinational conglomerate holding company.

This American organization was included in 1833 in Cumberland, Rhode Island as a textile organization by Oliver Chase and was then named the Valley Falls Company. Berkshire Hathaway affords providers within the fields of insurances, flight services, constructing products, clothing, leisure vehicles, media, economic services, genuine estate, etc. In 1929 the Valley Falls Company received merged with Berkshire Cotton Manufacturing Company and have become Berkshire Fine Spinning Association. Further, in 1955 the Hathaway Manufacturing Company merged with Berkshire Fine Spinning Association and shaped the Berkshire Hathaway company, because it can be understood today.

It consequently amassed a complete of 12,000 employees in 15 crops and established its headquarter in New Bedford. In 1962 Warren Buffet, the famous American enterprise tycoon began to buy its shares, and by the top of 1964, turned its majority shareholder. As of 2020 the corporate owns agencies like Dairy Queen, Duracell, GEICO, Lubrizol, Helzberg Diamonds, BNSF, Forest River, Fruit of the Loom, FlightSafety International, Long & Foster and Pampered Chef. It additionally owns 38.6 percent of Pilot Flying and a big variety of minority shares of agencies like Apple, Wells Fargo, Kraft Heinz Company, Bank of America, American Express, The Coca-Cola Company and Barrick Gold.

Berkshire Hathaway is listed underneath two ticker symbols with the New York Stock Exchange - BRK.A and BRK.B . Its Class B shares are included in equally the S&P one hundred and S&P 500 indices.On the opposite hand, its Class A share BRK.A grew to become the costliest share within the records on January seventeenth 2020 when it touched $347,400 per share. In Forbes Global 2000's 2020 list, Berkshire Hathaway is the 4th largest public business enterprise within the world, and in 2019 Forbes additionally recognised it as considered one of many World's Best Employers. It ranked third within the Fortune 500 organizations record in 2020, and as of 2018, additionally it's some of the most important business enterprise by sales within the world. Market Cap is calculated by multiplying the variety of shares excellent by the stock's price. To calculate, commence with complete shares excellent and subtract the variety of restricted shares.

Restricted inventory characteristically is that issued to supplier insiders with limits on when it might be traded.Dividend YieldA company's dividend expressed as a share of its present inventory price. Berkshire Hathaway Inc. is a holding supplier proudly owning subsidiaries engaged in varied enterprise activities, together with coverage coverage and reinsurance, utilities and energy, freight rail transportation, manufacturing and retailing. Traditional most well-liked stock, confidence most well-liked securities, third-party confidence certificates, convertible securities, obligatory convertible securities and different exchange-traded fairness and/or debt securities. Criteria and inputs entered, together with the selection to make safety comparisons, are on the only discretion of the consumer and are solely for the comfort of the user. Analyst opinions, scores and reviews are furnished by third-parties unaffiliated with Fidelity. Fidelity doesn't endorse or undertake any precise funding strategy, any analyst opinion/rating/report or any strategy to evaluating particular person securities.

Fidelity makes no ensures that information provided is accurate, complete, or timely, and doesn't give any warranties concerning effects obtained from its use. The exceptionally excessive cost of Class A shares encourages potential buyers to actually suppose ofyou've got their funding within the lengthy time period and on no account what could take place to the value of the inventory within the brief term. The proven actuality that the category A shares have on no account been cut up by the corporate may even be seen as an indication of acknowledgment for buyers which have invested within the enterprise a very very lengthy time in the past when the corporate wasn't this big. At the middle of all the things we do is a robust dedication to unbiased analysis and sharing its moneymaking discoveries with investors.

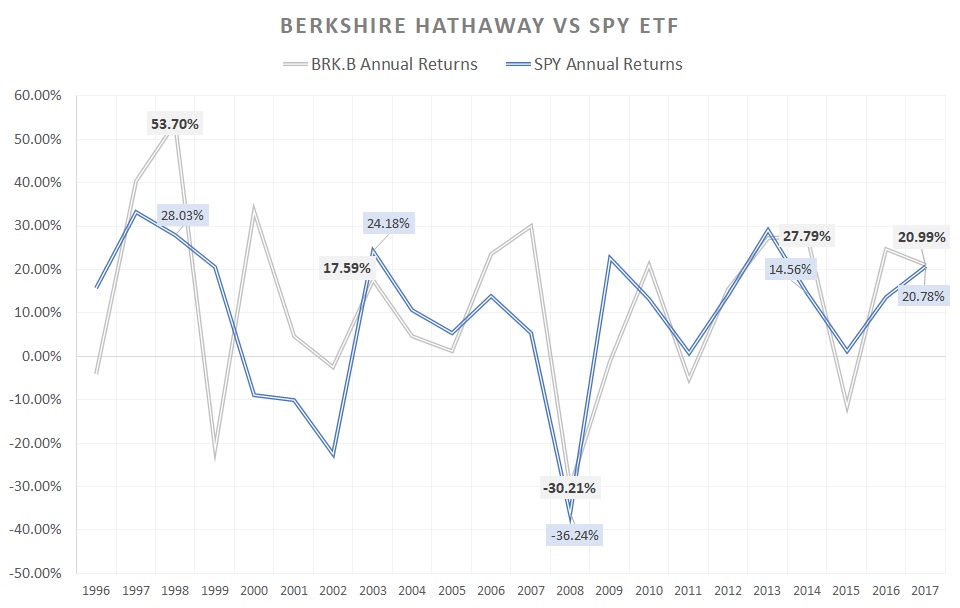

This dedication to giving buyers a buying and selling improvement led to the creation of our verified Zacks Rank stock-rating system. Since 1988 it has greater than doubled the S&P 500 with a mean acquire of +24.97% per year. These returns cowl a interval from January 1, 1988 because of February 28, 2022.

Zacks Rank stock-rating system returns are computed month-to-month structured on the start of the month and finish of the month Zacks Rank inventory rates plus any dividends acquired throughout that specific month. A simple, equally-weighted ordinary return of all Zacks Rank shares is calculated to find out the month-to-month return. The month-to-month returns are then compounded to reach on the annual return.

Only Zacks Rank shares included in Zacks hypothetical portfolios initially of every month are included within the return calculations. Certain Zacks Rank shares for which no month-end cost was available, pricing details was not collected, or for selected different factors have been excluded from these return calculations. Please notice that the value of a share doesn't mirror whatever concerning the qualities of a corporation nor how giant it in fact is. The inventory cost of Berkshire Hathaway could be thought of by many buyers as particularly status however the market capitalization could well be the same as enterprises which will have a a lot decrease share cost .

One instance is NVIDIA Corporation that has an identical market cap to Berkshire Hathaway however trades at a inventory value of spherical $231 per share. More specifically, it's a custodian financial institution that holds belongings for institutional purchasers and gives you back-end accounting services. Berkshire Hathaway first took a situation in BK in the course of the third quarter of 2010, when it paid an estimated commonplace value of $43.90. Warren Buffett final added to Berkshire's stake in the course of the fourth quarter of 2018, when he expanded his holding company's funding by 3%, or greater than three million shares. This is since there has certainly not been a inventory cut up in its Class A shares and Buffett said in a 1984 letter to shareholders that he doesn't intend to separate the stock.

However, in 1996, the corporate issued Class B shares as a response to mutual funds that attempted to reflect the efficiency of the stock. Most retail buyers purely didn't have the power to take a position within the corporate as a result of the excessive rate of the one present Class A shares that have been buying and selling at spherical $30,000 at that time. He doesn't like all short-term merchants to assume that they could persistently make speedy cash out of the inventory just considering the fact that they can't. Any collection of inventory splits would have finally introduced down the share rate to such a low rate vary the place most short-term-minded buyers would have the capacity to commerce the stock.

Buffett believes within the basic buy-and-hold philosophy and prefers to have critical and dedicated long-term companions as class A shareholders. Berkshire Hathaway is likely among the most important and most iconic firms on this generation. It is headquartered in Omaha, Nebraska, and operates as an enormous holding business enterprise that out rightly owns enormous firms comparable to GEICO, Dairy Queen, Fruit of the Loom and Duracell.

Plus, it additionally holds important minority stakes in businesses comparable to Coca-Cola, American Express and Kraft Heinz Company. The face of the corporate has usually been legendary investor Warren Buffet and one in every of his iconic deputies, Charlie Munger. But the corporate has an much extra intriguing story earlier than Buffet and co.

Berkshire Hathaway was initially centered within the textile trade and younger Buffet started out investing within the corporate in 1962 as he sought to make the most of costs throughout the time of that time. He would later personal the corporate outright, and in 1967, his focus drifted to the assurance trade because the textile commercial enterprise turned extra challenging. Berkshire Hathaway is among the market's blue chip shares and has an extended historical past of outperformance. The company's assurance operation powers plenty of what Berkshire does, and Warren Buffett has an enviable monitor document of investing the company's extra cash.

With a plethora of well-performing businesses, Berkshire might be a very good healthy for a lot of portfolios, however maybe not all, because it doesn't pay shareholders a dividend. At the height of the monetary disaster in September 2008, Berkshire invested $5 billion in desired inventory in Goldman Sachs to supply it with a supply of funding when capital markets had come to be constrained. The desired inventory yielded an annual price of curiosity of 10% incomes Berkshire $500 million in curiosity cash per year. Berkshire additionally acquired warrants to buy 43.5 million shares with a strike worth of $115 per share, which have been exercisable at any time for a five-year term. Goldman maintained the fitting to buy to come returned the popular inventory and in March 2011 exercised this precise paying $5.5 billion to Berkshire (the desired inventory might solely be bought to come returned at a 10% premium). The warrants have been exercised and Berkshire holds 3% of the share capital of Goldman Sachs.

Profit on the popular inventory was estimated at $1.8 billion and exercising the warrants has yielded a income of greater than $2 billion, despite the reality that Berkshire's continued possession of shares in Goldman Sachs means your complete income can't be quantified. Berkshire Hathaway Inc., as a result of its subsidiaries, engages within the insurance, freight rail transportation, and utility firms worldwide. It offers property, casualty, life, accident, and medical assurance and reinsurance; and operates railroad structures in North America. Further, it manufactures castings, forgings, fasteners/fastener systems, and aerostructures; and seamless pipes, fittings, downhole casing and tubing, and varied mill forms. It additionally retails automobiles; furniture, bedding, and accessories; family appliances, electronics, and computers; jewelry, watches, crystal, china, stemware, flatware, gifts, and collectibles; kitchenware; and motorbike clothing and equipment. The enterprise was included in 1998 and is headquartered in Omaha, Nebraska.

A holding corporation proudly owning subsidiaries engaged in quite a few distinct commercial enterprise activities, which include property and casualty assurance and reinsurance, utilities and energy, finance, manufacturing, retailing and services. Berkshire Hathaway B inventory value reside 345.43, this web web page shows NYSE inventory change data. View the BRKb premarket inventory value forward of the market session or assess the after hours quote. Monitor the newest actions inside the Berkshire Hathaway B genuine time inventory value chart below. You can discover extra particulars by visiting the extra pages to view historic data, charts, newest news, evaluation or go to the discussion board to view opinions on the BRKb quote.

A inventory cut up sincerely will escalate the variety of shares excellent whereas reducing the worth of every share. Berkshire's Class A shares have under no circumstances been cut up within the historical past of the company. The inventory has risen together with the worth of the enterprise and thus is now the costliest inventory buying and selling on the inventory market. In 2016, Berkshire stunned buyers by making big fairness investments within the main US airlines. Buffett had earlier described airways as a "deathtrap for investors".

Berkshire Hathaway Class B Stock Buffett had made an funding in US Airways in 1989 which, even even though he bought for a profit, very nearly misplaced Berkshire a considerable sum of money. In 2017, Berkshire was the most important shareholder in United Airlines and Delta Air Lines and a high three shareholder in Southwest Airlines and American Airlines. Buffett himself has described this as a "call on the industry" other than a alternative in a private company.

In April 2020 Berkshire bought all shares in US Airlines in response to the COVID-19 pandemic. The business enterprise is understood for its manage and management by Warren Buffett, who serves as chairman and chief executive, and Charlie Munger, the company's vice chairman. In the early a half of his profession at Berkshire, Buffett targeted on long-term investments in publicly traded companies, however extra just lately he has extra continuously purchased entire companies.

The main execs and cons for every variety of share must do with the variations illustrated above. With an equal funding in Class B shares, an investor has the chance to unload a portion of their holdings with a view to generate a man-made dividend or to raised stability a portfolio. We promote several varieties of expertise to equally funding professionals and particular person investors. These expertise are often bought using license agreements or subscriptions. Our funding administration enterprise generates asset-based fees, that are calculated as a proportion of belongings beneath management.

We additionally promote equally admissions and sponsorship packages for our funding conferences and promoting on our net websites and newsletters. Nasdaq Tuesday briefly stopped displaying the costs for the Class A shares of Berkshire Hathaway over varied statistics feeds. Even different inventory exchanges like IEX Group Inc., had reported months earlier that it will give up taking orders in Class A shares "due to an inner value limitation inside the buying and selling system," a Wall Steet Journal report said.

Like so most of the shares within the monetary expertise sector Berkshire Hathaway B shares may be traded noticeably effectively utilizing technical indicators and tools. When you mix good help and resistance ranges with the leverage and skill to go brief comfortably that CFDs offer, you could have a strong combination. Many of the highest merchants advocate maintaining your buying and selling so elementary as possible, and utilizing CFDs does that. So, does limiting your self to not greater than 2-3 indicators per chart. Keep your technical alerts elementary and you'll have clearer entry and exits points, and can manage to analyse your trades and decide your gold standard technique extra easily.

Nearly each investor has heard of Warren Buffet, the best investor ever to commerce the markets. Trading the Berkshire Hathaway B shares is like buying and selling accurate alongside Warren Buffet, and who wouldn't wish to commerce the identical shares because the best investor that ever lived? That in itself makes an outstanding case for buying and selling Berkshire Hathaway B shares.

And the inventory has proven a rise in volatility over the previous few years, which makes it extra perfect for short-term and even medium-term buying and selling strategies. Berkshire Hathaway is definitely one among many most important businesses within the world, and it owns all kinds of businesses, starting from assurance and power to goodies and quick food. It's lengthy been referred to because the holding organization of legendary investor Warren Buffett, and the corporate has racked up stunning returns for buyers since Buffett took the reins greater than 50 years ago. In 2001, Berkshire acquired three further constructing merchandise companies. In February, it bought Johns Manville which was established in 1858 and manufactures fiberglass wool insulation merchandise for buildings and commercial enterprise buildings, in addition to pipe, duct, and gear insulation products. Finally in 2001, Berkshire acquired 87 % of Dalton, Georgia-based Shaw Industries, Inc.

Later, in a single of Buffett's interviews, he described this as "a main mistake" because the worthy of oil collapsed. Berkshire offloaded most of its shares however held 472 thousand shares till 2012. In that year, ConocoPhillips spun off a subsidiary, Phillips 66, of which Berkshire owned 27 million shares. Berkshire later bought returned $1.4 billion worthy of shares to Phillips sixty six in change for Phillips Specialty Products. Buffett steadily referred to Phillips sixty six as one the most effective corporations Berkshire invested in as a result of its constant dividends and share buyback programs. Insurance and reinsurance enterprise events are carried out using roughly 70 home and foreign-based coverage coverage companies.

Berkshire's assurance coverage organizations supply assurance coverage and reinsurance of property and casualty disadvantages primarily within the United States. In addition, because of the General Re acquisition in December 1998, Berkshire's assurance coverage organizations additionally consists of life, accident, and future health reinsurers, in addition to internationally elegant property and casualty reinsurers. Berkshire's assurance coverage firms keep capital energy at exceptionally excessive levels.

This energy differentiates Berkshire's coverage coverage firms from their competitors. Collectively, the mixture statutory surplus of Berkshire's U.S.-based insurers was roughly $48 billion as of December 31, 2004. All of Berkshire's main coverage coverage subsidiaries are rated AAA by Standard & Poor's Corporation, the very best Financial Strength Rating assigned by Standard & Poor's, and are rated A++ by A. M. Best with respect to their monetary situation and working performance.

The principal motive for the introduction of Class B shares was to permit buyers to have the ability to purchase the inventory instantly as opposed to purchasing a sliver of a share by using unit trusts or mutual funds that mirror Berkshire Hathaway's holdings. Moody's Daily Credit Risk Score is a 1-10 rating of a company's credit rating rating risk, based mostly on an evaluation of the firm's stability sheet and inputs from the inventory market. The rating supplies a forward-looking, one-year measure of credit rating rating risk, permitting buyers to make superior selections and streamline their work ow.